Euro, pound surge as U.S. rate cut odds grow after Powell hint

Anabelle Colaco

29 Jun 2025, 05:06 GMT+10

- The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and Swiss franc, as markets ramped up bets that the Federal Reserve will cut interest rates sooner—and more aggressively—than previously expected

- The decline followed Fed Chair Jerome Powell’s comments to Congress this week, which investors interpreted as dovish

- Powell repeated that inflation could rise this summer but noted that “we will get to a place where we cut rates sooner than later” if price pressures remain contained

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and Swiss franc, as markets ramped up bets that the Federal Reserve will cut interest rates sooner—and more aggressively—than previously expected.

The decline followed Fed Chair Jerome Powell's comments to Congress this week, which investors interpreted as dovish. Powell repeated that inflation could rise this summer but noted that "we will get to a place where we cut rates sooner than later" if price pressures remain contained.

That tone opened the door to a potential rate cut as early as July, according to traders and analysts.

"This week it's definitely been about the Fed," said Eric Theoret, FX strategist at Scotiabank. "The prospect of easing sooner and potentially more rate cuts" is driving the current selloff in the dollar, he said.

Noel Dixon of State Street Global Markets added: "Powell kind of opened the door to potentially a July cut. If the next CPI release is below market expectations, I think markets will start to price in the probability of a cut to July."

As of Friday, Fed funds futures showed a 23 percent probability of a July rate cut, up from 13 percent just a week ago. The likelihood of a cut by September now stands at 93 percent. Traders are currently pricing in 66 basis points of easing by year-end—indicating a potential third 25-basis point move, up from 46 basis points last Friday.

Adding to the pressure on the dollar, President Donald Trump said he plans to nominate a new Fed Chair once Powell's term ends in May 2026. Trump, who has long criticised Powell, said this week that he has "three or four" potential replacements in mind and could name one by September or October. The Wall Street Journal reported that the choice could act as a "shadow Fed Chair," potentially undermining Powell's influence.

"That could be a problem if inflation reaccelerates," said Dixon. "The message there would be that they would discount the inflation."

However, Chicago Fed President Austan Goolsbee pushed back on that idea, stating that any replacement named before confirmation "would have no influence on monetary policy."

This week In forex markets, the euro rose 0.51 percent to US$1.1719, reaching as high as $1.1744—its strongest level since September 2021. The British pound climbed 0.62 percent to $1.3748, touching $1.3770, the highest since October 2021. The Swiss franc surged to 0.799 per dollar, a 10.5-year high. The dollar slipped 0.72 percent to 144.2 yen.

Beyond the Fed, investors are watching two other key U.S. deadlines: a July 9 target for avoiding new trade tariffs, and a July 4 Senate goal for passing a tax and spending bill. That legislation, if passed, could boost growth and potentially support the dollar.

But for now, structural concerns remain. "The budget and current account deficits are negative for the dollar," Dixon said.

Longer term, a reallocation of international capital away from U.S. assets could also weigh on the currency. "You've got a lot of asset managers that are long the U.S. dollar way more than I think they're comfortable," said Theoret.

In crypto markets, bitcoin dipped 0.43 percent to $107,382.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Sacramento Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Sacramento Sun.

More InformationBusiness

SectionLululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

International

SectionBeijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

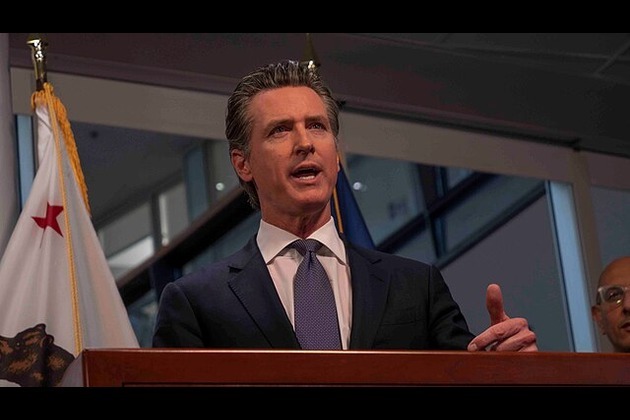

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...